Boeing has not had it easy for the last couple of months, with the grounding of the 737 MAX, the latest 787 Dreamliner manufacturing faults and the COVID-19 pandemic slowing aircraft sales to a trickle compared to former years, late 2019 and 2020 to date, have not been memorable.

However, September 2020 could signal the change in fortunes that Boeing desperately needs. Boeing said the coronavirus epidemic this year has further increased the demand for freighters carrying vital medical supplies and equipment, and also has pushed airlines to shift more of their business to air cargo.

737-800BCF

To back this statement, an unidentified customer announced a firm order for two 737-800 Boeing Converted Freighters (BCF). This in turn has lead Boeing to open additional freighter conversion lines in Guangzhou, China, and Singapore to meet strong market demand. The new 737-800BCF line at ‘Guangzhou Aircraft Maintenance Engineering Company Limited’ (GAMECO) is scheduled to open in early 2021, which will allow GAMECO to significantly increase its production capacity to meet the surging demand for freighters.

“The addition of the new production line demonstrates our ability to quickly respond to market trends and requirements and is a testament to the skill and professionalism of the entire GAMECO-Boeing team,” said GAMECO General Manager Norbert Marx.

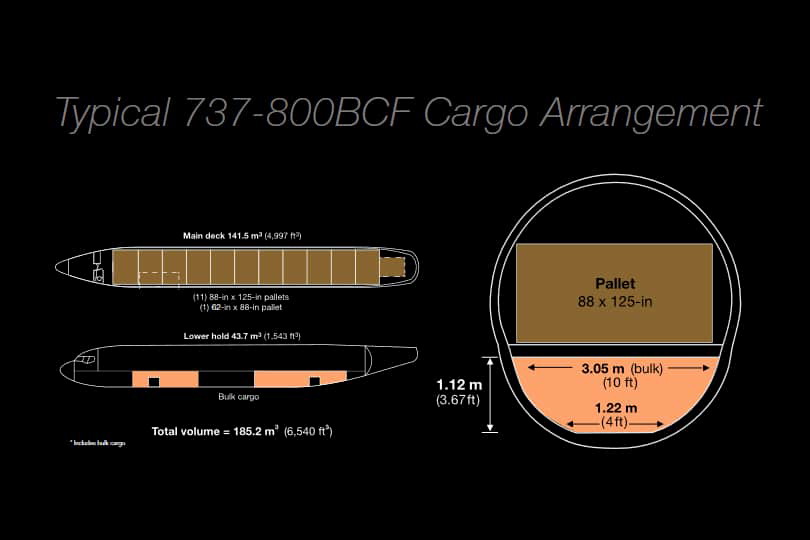

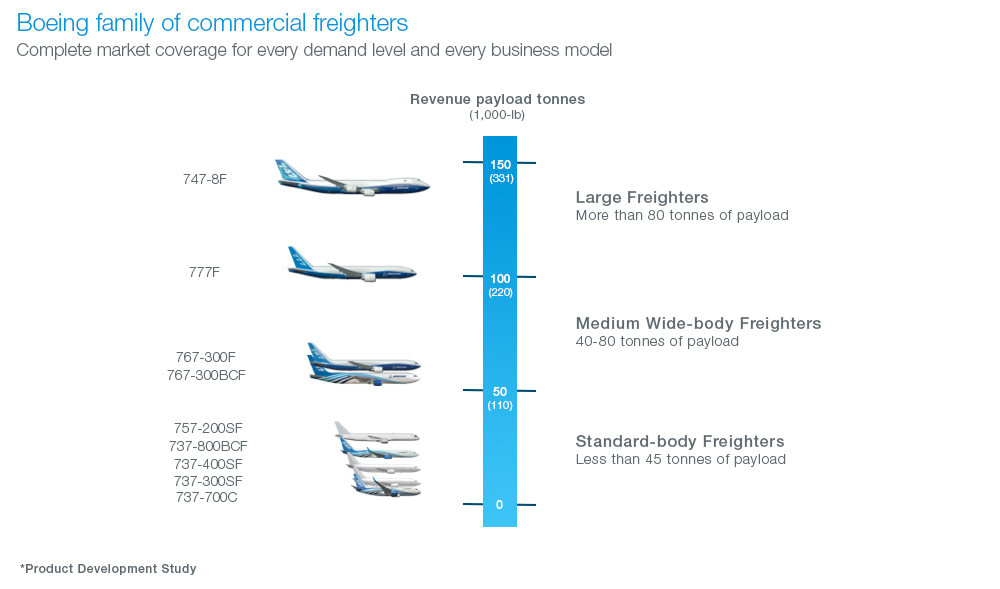

Based on the popular Next-Generation 737, the 737-800BCF offers operators newer technology, much lower fuel consumption and higher reliability than other standard-body freighters. Primarily used to carry express cargo on domestic or short-haul routes, the aircraft is capable of carrying up to 23.9 tonnes and flying up to 2,000 nautical miles (3,750 kilometres).

The launch of the 737MAX has left behind large numbers of 737-NGs at the age and valuations that make freight conversions attractive. To work, current aircraft must be available cheaply enough on the second-hand market, with about 15-20 years on the clock, to cover the cost of conversion and make a profit.

Ihssane Mounir, senior vice president of Commercial Sales and Marketing for Boeing, said, “The freighter conversion program is an excellent way to double the life of an aircraft and provide operators with an economical way to replace less efficient freighters. By working with our partners to add freighter conversion capacity, we look forward to meeting the strong demand in this market segment and helping our customers scale their operations.”

767 – 300BCF

Boeing will also add a second conversion line for its wide-body converted freighter, the 767-300BCF, at ST Engineering’s facility in Singapore. The second line is scheduled to open later this year.

The world’s most efficient freighter in its class, the Boeing 767 freighter family offers the lowest operating costs per trip and allows airlines to develop new opportunities in the long-haul, regional and feeder markets. The 767-300BCF has virtually the same cargo capacity as the 767-300F production freighter with up to 56.5 tonnes of payload and flying up to 3,350 nautical miles (6,190 kilometres).

“Our strong talent pool, operational flexibility and existing infrastructure allow us to adapt quickly to evolving market needs and render the necessary support to our partners and customers,” said Lim Serh Ghee, president (Aerospace) of ST Engineering. “We take pride in our partnership with Boeing and, with the opening of an additional line later this year, look forward to continuing to deliver timely and quality freighter conversions.”

History

Boeing announced in late 2014 that the board had given authority to offer a 737-800 Boeing Converted Freighter (BCF) to operators.

The first aircraft, a 737-800BCF for West Atlantic, was converted by the Chinese modification joint venture ‘Boeing Shanghai Aviation Services’ and was delivered in April 2017.

Future looking brighter

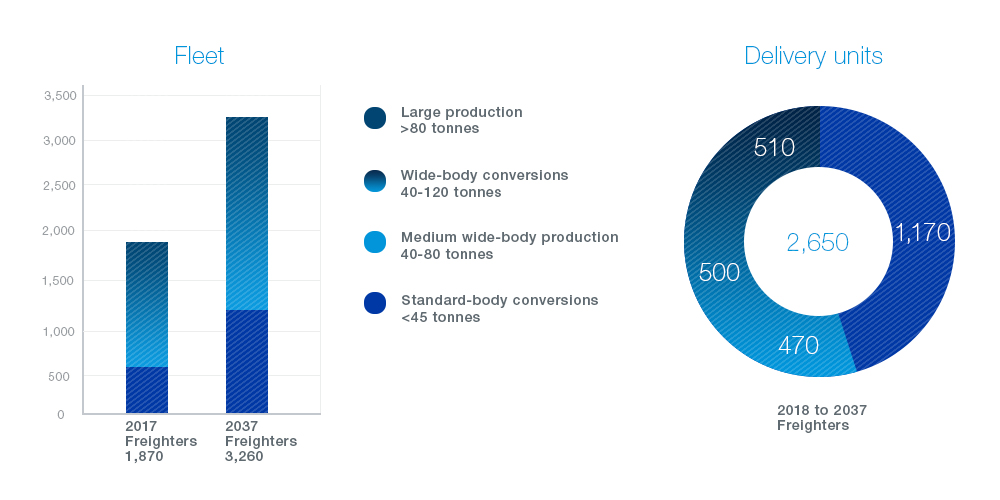

According to Boeing, the Boeing freighter family, which includes production and converted freighters, provides more than 90% of the world’s freighter capacity, offering an unmatched selection of capacity and capability with superior economics in every freighter size.

This brings the total commitments and orders for B737-800 freighters 134. To date, Boeing has delivered 36 Boeing 737-800BCF to more than 10 operators across four continents.

Boeing is also reviewing the aircraft conversion processes to reduce flow times. The need for the aircraft is driven by three main considerations:

- The first is regulatory pressure in key markets where there are age limits on aircraft, such as China;

- Secondly, demand in China is such that there will not be enough 737-400s to meet requirements;

- And finally there is a need for more advanced avionics to take advantage of RNP and FANS capabilities, which today require airlines to invest between $2 and $3 million to upgrade older generation 737-300s and -400s.

With the 737-800 deliveries having started in 1998, there is still very high demand for this aircraft for passenger use, with many being part of sale/leaseback deals. Many of these aircraft have now been returned after their 10 year leases having expired.

New 737-900 BCF?

Boeing is also considering the 737-900ER BCF, but not until the early 2020s. This conversion would potentially offer higher payloads than the current 737-800 BCF, getting somewhat closer to the 757-200SF which is ideally suited to the Chinese market. Despite demand being strong for the 757, feedstock is extremely limited due to both the FedEx acquisition of more than 100 aircraft, with more from United, and the fact current operators are hanging on to their aircraft until the end of their economic life.