It is said that in times of crisis, only the fittest survive. Airlink has demonstrated that it is indeed one of the fittest by emerging from the Covid-19 pandemic in a better position than it was before the crisis began. Guy Leitch asks Rodger Foster how Airlink did it and what its future plans are.

Rodger Foster

Guy Leitch

GL: In the past you specialised in feeder routes. But now you have been successfully operating the high density and frequency Joburg – Cape Town route since the domestic lockdown ended. Yet you use small gauge 98 seat Embraers while your competitors operate more economical 185 seat Boeing 737-800s?

RF: While loads are recovering the smaller gauge aircraft present lower economic risk as their trip cost is significantly lower than the Boeing or Airbus trip cost. And it doesn’t matter much if our seat cost is slightly higher as we are not trying to compete in the low-cost carrier market. Airlink has a competitive advantage in that it has a comprehensive airline network system where our customers can connect to myriad destinations within our network and they have access to the global networks of our commercial partner airlines. Our Economy Class fares include a 20kg free checked-in luggage allowance plus a 15kg sporting equipment allowance. Onboard, we provide a light meal, refreshments, generous leg room and a choice of aisle or window seat, as our flights do not have middle seats. Our “Intra-continental Business Class” service is available on selected flights operated by our Embraer E-jets, and includes complimentary meals and beverages, a 30kg check-in luggage allowance and priority boarding, as well as access to business class lounges at select airports.

With the return to flying of kulula.com and Mango presumably continuing on the so-called Golden Triangle of Joburg – Cape Town, and possibly Durban, it becomes even more heavily traded and thus competitive. Do you imagine that you will continue to be able to compete against the Low Cost Carriers? Or will you withdraw from this route?

Not at all. We have every intention of continuing with the trunk routes as they are very much part of our broader network strategy. Since we no longer have our franchise agreement with SAA we have to build our own wide connectivity network, and that includes Cape Town.

Has your route network philosophy therefore changed since you uncoupled from SAA?

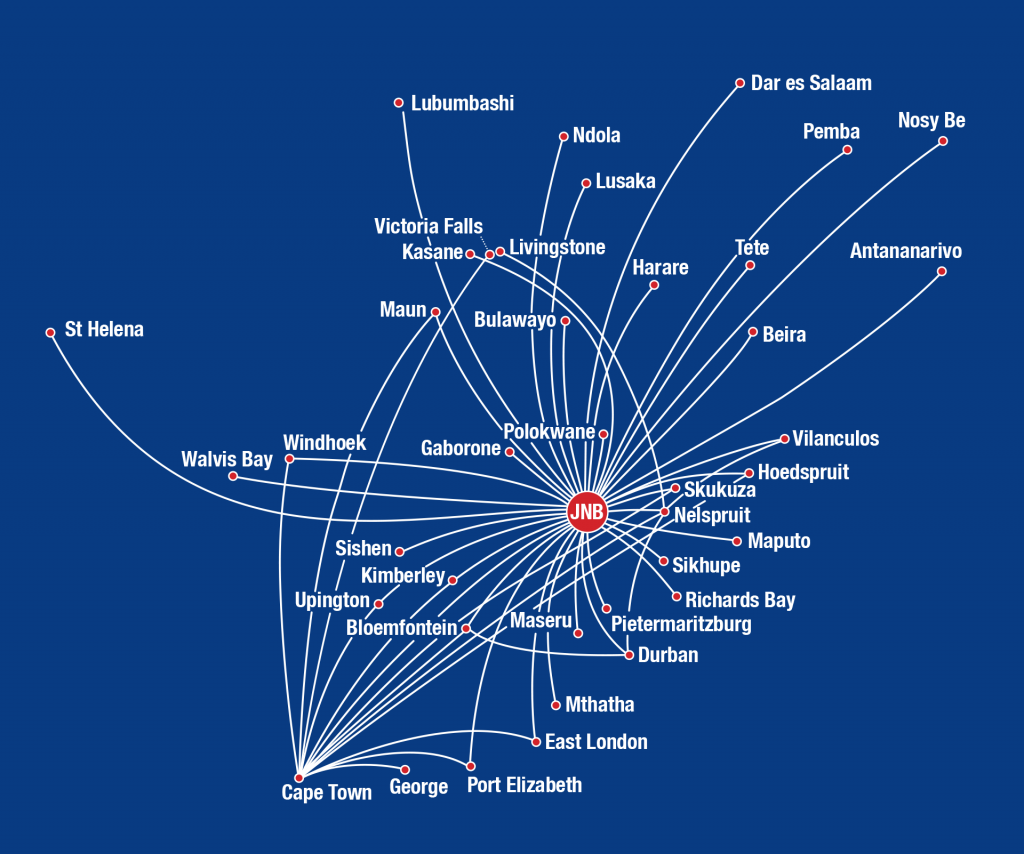

Yes, to some extent in that we now need to have our own wide network. We have already expanded to over 60 routes across the sub-region and we are adding destinations such as Lubumbashi in the DRC and Dar Es Salaam in Tanzania. However, our core values are unchanged, and that is to be the best that we can in terms of our own network system.

With the loss of the SAA franchise agreements have you had to go out and aggressively replace your interlining agreements and codeshare agreements?

Our commercial partners have recognised the allure of Airlink’s expansive network of destinations and have worked closely with us to speedily emplace these new relationships, because they’re the ones who most benefit from our ability to feed our network into their long haul routes. We are also expecting that our current interlining contracts will gradually be upgraded to codesharing, which will provide a completely seamless interface for travellers wanting to get from an International destination to one of the many regional destinations we serve.

“Replacing the SAA franchise agreements is just a first step…”

How significant is the loss of SAA franchise to your business?

SAA only carried about 15% of the international market to SA before going into business rescue, so it is not critical. But replacing the SAA franchise agreements is just a first step and we will continue to expand our interlining agreements with many other airlines. We are especially looking forward to the increase in long haul connectivity being provided by other players. For instance, United has already announced that it will be providing flights from New York’s Newark to Johannesburg from March and we have heard of a number of other airlines also planning new direct flights into South Africa.

One of the consequences of the decoupling from SAA has been the need to rebrand your business and your fleet. I see that the first aircraft has now been rebranded.

Yes, we are doing the repainting as the aircraft come in for major maintenance, so it will be a protracted process. We have made the new brand distinctive and yet we have kept our key emblem; the sunbird, which we like because it is both endemic to our region and fulfils many of our own ideals in being nimble, agile and small. We have also changed our corporate name to Airlink (Pty) Ltd.

Are you planning to further expand your route network, especially with the space created by the demise of SA Express?

Yes. We have however had to battle for designation or traffic rights on some routes such as for instance Windhoek. However, we have resolved the legacy issues and are making steady progress as regards procurement of foreign operator’s permits.

“The lack of international travellers means that we are still not operating at a 100% of capacity.”

Will you be expanding your fleet to accommodate the route growth?

Not at the moment as the lack of international travellers means that we are still not operating at a 100% of capacity. But yes, once international travellers start returning then we will have to look at expanding our fleet.

If you continue to operate on the Low Cost Carriers’ routes would you consider moving to Airbus or Boeing products with high density seating?

Probably not. We find our Embraer relationship extremely good and it is difficult and quite costly to change to another fleet or type, as we discovered with the change from the RJ-85 to the Embraer EJet fleet a few years ago.

If you ever did decide to switch to Boeing or Airbus, would you outsource your maintenance on those?

No. We believe that it is absolutely vital to our success that we manage our own maintenance, that we have it under our control if our standards are to be maintained.

And these standards presumably include On Time Performance (OTP) – a critical performance area for a feeder airline.

Yes. I am, very proud that our On Time Performance is still the best with year to date at 96.06%. In October it improved to a fantastic 97% which is significantly better than FlySafair’s still very creditable 95.25% for the year to date and 96.48% for October. So I am comfortable that we will soon be growing again, and that we are still doing the key things best.